Aligning capital needs to investment types

By the Energy Catalyst team

The Energy Catalyst Accelerator Programme (ECAP) accelerates the innovation needed to end energy poverty and improve lives across Africa and Asia. Since its establishment, ECAP has provided business acceleration support, including advisory support—to over one hundred innovative companies in the energy sector. In supporting these companies, we have observed that successful fundraising depends on aligning a company’s capital needs to the right type of investment and suitable investor. Based on this experience, we are sharing some key insights about the process as well as some general top tips for fundraising.

Insight 1: The capital raise process is long and nuanced

Fundraising is a complex, nuanced, and time-consuming process. On average, the entire process takes 6-12 months. Adequately planning for this is crucial to ensure you have sufficient cash runway to keep your business afloat. You only get one or two opportunities with each prospective investor, and it is crucial to get the process right from the get-go, from building a compelling narrative, presenting it to the right audience, to eventually raising funds. It is more of an art than a science.

Generally, there are three main types of capital—debt, equity, and grants—with varying structures but similar core features. For example, debt might take on the form of a term loan—a bank loan with a specified repayment schedule and a fixed/floating interest rate, or inventory finance—debt obtained to pay for products that are not intended for immediate sale (financing is collateralized by the inventory it is used to purchase). In terms of grants, some can be repayable while others are not, but all grants can be used to prepare a business for other sources of capital.

When looking to secure funding, businesses typically go through a 3-phase capital raise process: preparing the business, engaging investors, and closing the deal.

The 3-phase capital raise process

In this blog post, we focus on determining the right capital structure, by evaluating and choosing the type of capital that most closely fits your business’ needs, which is particularly important to prioritize the right type of investment. We also cover how to build an investor pipeline that targets the appropriate types of capital.

Insight 2: Your value chain position is one determinant of the right type of capital for your business

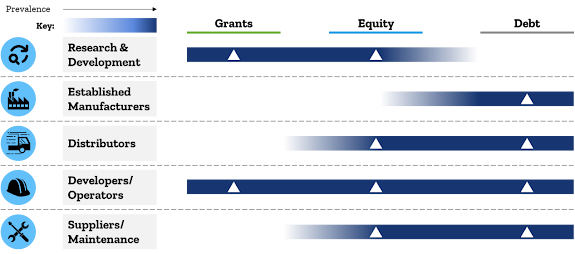

While businesses are not limited to pursuing any one form of capital, some types tend to be more suitable than others depending on your business' position in the value chain.

Suitability of capital type by value chain position

For example, research & development companies are more likely to take on grants and equity than debt since these businesses often take a while to start generating any cash. On the other hand, established manufacturers are more likely to take on debt since their cash inflows are more consistent and predictable, which allows them to make debt repayments (principal and interest) almost immediately.

Insight 3: Your income stage is another key determinant of the type of capital you should seek

Distinct types of capital have different costs, which may limit your company’s ability to access them. The income stage your business operates in (pre-revenue, post-revenue, EBITDA positive or net profit positive) can make it difficult and/or expensive for your business to access certain instruments. The further you are from generating positive free cash flow, the more risk appetite your investors will need. You can still access debt before you are generating positive free cash flow, but it will most likely be more targeted depending on your working capital need. For example, it may take the form of patient capital instruments with generous interest rates and grace periods.

Preferred capital type by income stage

Beyond free cash flow, other key factors include the business’ existing capital structure and intended use of funds. Highly leveraged businesses may also find it difficult to further raise debt capital. Lastly, your business’ intended use of the funds will influence the timing of prospective returns and cash flows, which will in turn favor specific capital instruments.

Insight 4: Understanding the investor goes a long way in presenting a clear and compelling narrative that resonates with investors

Once your business has determined the right capital structure, your business needs to build the right investor pipeline. Investors receive many requests, so it is important to confirm that your investor materials are aligned with their interests. Attending capital raise/investment readiness webinars and conferences is an easy way of enriching your perception of investors’ interests and getting insights into the investor mindset.

As you build your investor pipeline, it is important to familiarize yourself with key investor characteristics to position yourself and your business to successfully raise capital. Understanding whether an investor is an impact investor, a traditional investor, or a philanthropic will position you to better identify key areas they focus on. For example, traditional investors will prioritize financial returns over impact whereas impact investors will consider both with a focus on impact. Understanding the investment criteria will also position you to reach out to investors that best match your growth stage. These include the capital type offered, average ticket size, geographic focus, sector focus, and any impact goals. Your business’s ability to raise capital is also heavily dependent on the investor’s investment horizon. For example, private equity firms in Africa typically exit after 5-8 years, and the returns at that point must justify the initial investment made.

Investor characteristics by investment type

Ensuring your company’s capital needs are aligned to the right investment types and the right investor is crucial when seeking to raise capital. Here are a few pointers to help you achieve this:

- Putting in enough time upfront to understand what your target investors look for will allow you to develop investor materials (teasers and memos) that resonate with them, and help you ‘get your foot in the door’ (secure your first meeting)

- When raising equity, it is important to identify whether your potential investors are likely to be leaders versus followers; the leaders will effectively price the fundraising round and take up a significant chunk of your ticket size, so reach out to them first to build traction. The same approach can be used when raising debt at ticket sizes that may require syndication

- While investors expect you to justify why they should fund your company, you can also ask them to justify why they are the right investor for you. For example, does the investor provide post-investment support like technical assistance? Do they boast key connections/industry knowledge?

- Create a ‘FOMO’ (fear of missing out) effect with potential investors by mentioning the other reputable investors you are in talks with/who have expressed interest (your leads)

- When approaching corporate/strategic investors, consider any potential conflict of interests, for example, competing products in the same market, and their implications on other investors.

Energy Catalyst is a Gold Sponsor of the Off-Grid Solar Forum & Expo 2022.

.jpg)

.jpg)

Comments

Post a Comment